Abundant Supply, Iron and Coal Ore Prices Predicted to Decline This Year

External News - 16 Feb 2018

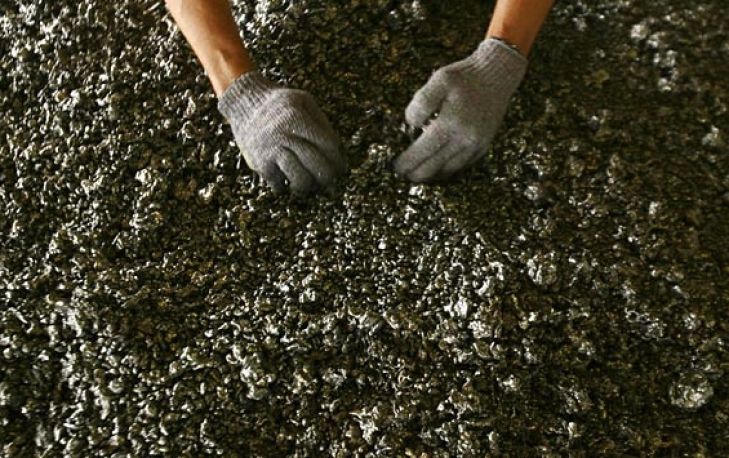

Australia estimates this year's iron ore prices to average USD51.50 per ton, a drop of 20 percent from 2017, due to rising global supply and moderate demand from major Chinese importers, after the steel sector slumped. The three largest mining companies in the world, BHP and Vale, rely heavily on the sale of iron ore for a large part of their income, despite trying to diversify more into other industrial raw materials, such as copper, aluminum and coal.

Vale, based in Brazil, targets exports of iron ore to increase by seven percent in 2018 to 390 million tons. In Australia, Rio Tinto and BHP, along with Fortescue Metals Group, hope to add around 170 million tons of new capacity over the next few years. The projected decline in prices - from an average of USD64.30 per ton in 2017 - continues through 2019, when steelmaking raw materials average only USD49 per ton, according to the Australian Department of Industry, Innovation and Science, Reuters reported. in Sydney, Monday (1/8).

"Iron ore prices are expected to experience ongoing volatility in early 2018, as the market responds to uncertainty about the impact of restrictions on winter production on demand for iron ore," the department said in a paper on its latest commodity prospects. Iron ore currently sells for around USD75 per ton. Lower prices will reflect increases in supply from low-cost producers and moderate demand from China because the country's steel industry has contracts, the department said.

China is in the process of shutting down old and high polluting steel mills and induction furnaces to suppress excess capacity in this sector. Last October, Chinese President Xi Jinping said that fighting pollution is one of the country's main tasks until 2020. The price of coking coal - another major raw material in steelmaking - is estimated that the department will drift lower over the next 18 months from benchmark prices last quarter was USD192 per ton because of the increase in supply exceeding demand.

It is also estimated that thermal coal prices will weaken in 2018 and early 2019, with Newcastle spot price predictions down 12 percent to an average of USD77 per ton in 2018, and another six percent to USD70 in 2019.